Over the last five years, properly priced homes have been fetching multiple offers on a consistent basis.

It is, without a doubt, a seller’s market.

But as exciting as having a bidding war on your property is, it can also provide for some confusion and even anxiety in figuring out what to do with all those offers.

Your natural instinct might be to choose the one that lets walk away with the most amount of money, but there are many other aspects of offers to consider that contribute to the offer’s overall strength. Let’s take a closer look at the best approaches to dealing with a multiple offer situation so that you come out on top.

Request everyone’s highest and best. The fairest thing for all buyer’s offers and the best way for you to get the strongest offers to look at is to have your buyer’s agent request that all buyers come back with their highest and best offers...all by a specific date.

Handling the process in this way forces all potential buyers to come to the table with their absolute best offer (or to leave the competition if they’re not serious). This creates an auction atmosphere and drives up people’s excitement for your home, hopefully making it less likely that they’ll hold back in their offer.

Sure, you’re not really negotiating at this point, but you will be with the best offer that comes your way. Your goal at this point is to have the “cream rise to the top” and get the absolute best offer to work with. Remember, we’re looking for the strongest overall offer and it’s likely that in this situation, the strongest offer is also the highest offer. It also not be the most financially beneficial, but overall, it should meet your needs the best.

Either way, you’re doing what’s going to secure you the best results..

Tell them what you want. When you have multiple offers, you are in the unique situation to request that buyer’s “customize” their offers to what’s most pleasing to you.

What that means is you can ask prospective buyers to include specific terms and conditions in their offer like a quick closing date, a larger earnest money deposit, time for you to find your next home with a rent-free, lease-back period, etc.

Handling things this way will certainly help an incredible offer specific to your needs rise to the top.

Money talks. It’s one thing to have multiple offers. It’s another thing to have multiple offers from qualified buyers.

If you want to separate the best offers from the rest, they you’ll want to look at the financial aspect of each buyer’s offer.

Offers where the buyer is pre-approved with a reputable financial institution are clearly more attractive. As well, if the pre-approval is subject only to an appraisal, then that speaks volumes about 1) how serious the buyer is and 2) how qualified they are as buyers.

Another part of this is the earnest money deposit. The more money the buyer puts down with their offer, the more serious and qualified they are as prospective buyers. A larger earnest money deposit gives the seller the peace of mind that the buyer is willing to be out of the service of that money in order to have the best shot of owning their home. And, while there are conventions in the purchase and sales agreement that give the buyer the ability to walk away from the deal and still get their money back, a larger earnest money deposit speaks volumes about the buyer’s desire to buy your home.

Challenges pop up all the time during the course of the transaction. Whether it be an appraisal problem, a home inspection issue or financing problem, you want to know in your heart that the buyer is committed to seeing the transaction through to the end.

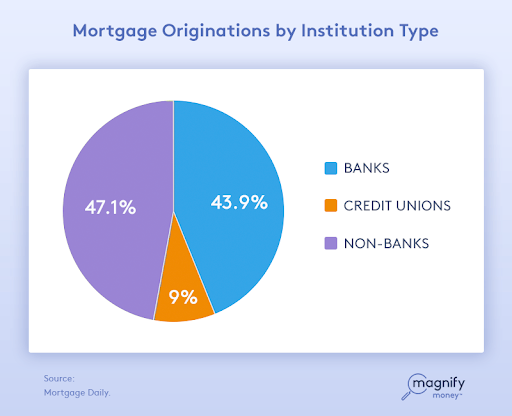

The type of financing matters. As you review the offers, you’ll want to see what type of loan the buyer is bringing to the table. Some financing programs are more desirable than others and you want to be sure you pick the one that will allow you to sleep at night during the home sale process.

Your agent should be able to provide an explanation of the pros and cons to each option, but here are a couple of things to consider:

-

Cash is usually best:Historically, a full-cash offer means no financing contingency and likely no appraisal requirement. Also, the time it takes to close the loan will be far less involved and much shorter.

-

Veterans Administration (VA) Loan: VA loans, while completely guaranteed by the US Government can be a little tougher because the VA has some specific requirements about what they’ll allow and not allow with the homes that get their financing. If you’re home needs some work, a VA loan might not be the best home for your needs.

-

FHA Loan: FHA loans give buyers the chance to own a home with a relatively small down payment. FHA loans also have some requirements about what they will and won’t allow in a home, but they are far less stringent than VA. FHA loans are great loans for people who can afford the monthly payment for a home, but don’t have 10% or 20% to put down.

-

Conventional loan: With 20% down and not a lot of stipulations required of the buyer for the home they’re buying. Historically, these loans are favored by agents and their sellers. That said, buyers with other loan types are also great prospects for buying a home.

Always sit with your agent and look at the complete picture of each offer you get as financing, again, is only one part of the whole offer.

The good, the bad and the ugly. Ultimately, you’ll need to put each offer side by side and look at what’s good and what’s not so good for each offer you’ve received: Finances, earnest money deposit, due diligence periods, appraisal date and requirements, closing and all the other terms and conditions of the offer.

Some conditions will be favorable and others will not be. As well, some offers might include a letter from the buyers with a picture and others will not. The important thing for you is to look at each offer on the whole and determine which offer — and which accompanying buyer — you’re going to want to work with for the entirety of the sales process until closing.

Remember, it’s your goals that matter in the process. You’ll want to be as objective as possible in making your decision and focus completely on the offers you have and which one is best for you.

Taking the time to come up with the right offer is the best thing you can do to handle a multiple offer situation properly.