Selling your home, while exciting, can also be extremely stressful. Even the best of real estate agents have to deal with complicated issues that arise with a home sale.

In fact, you’ll find that even when seller and buyer get along great and the sales process is humming along smoothly that challenges can crop up requiring lots of negotiations and may delay the transaction weeks before you can close on the transaction.

Conversely, some deals are complicated from day one as they encounter major roadblocks that could threaten the home sale completely.

In fact, there are a few major deal breakers that can pop up in any home that’s under contract to be sold. They are significant enough that they could potentially prevent the deal from going through as planned.

Here’s a look at the top deal breakers for a home under contract and how to

Significant Repair Issues

The home inspection a buyer conducts once they put a home under contract is often a huge deal killer. Yes, some of the repairs a home needs might be known by both seller and buyer before a property inspection is complete, but the inspection report can, and often does, bring to light more issues that are not apparent to the naked eye.

Often times, buyer get freaked out when the home inspection report comes back and details some significant issues that need to be resolved within the home. Unfortunately, some buyers don’t even want to go back to the negotiating table after they see their home inspection report.

When this happens, your deal is busted.

The good news is that you can prevent this from happening by conducting a home inspection yourself before you put the home on the market.

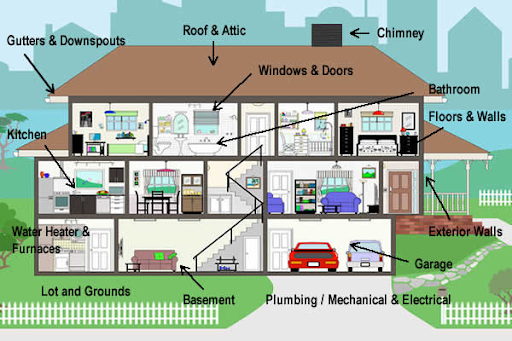

Before you let one buyer set foot in your home, hire a certified home inspector to look at the major systems and structures of your house:

-

Roof

-

Structure and foundation

-

Hot water heater

-

Furnace

-

Electrical System

-

Well and Septic (as they apply)

The issues that arise in these areas of your home cause buyers the most concern and repairing or replacing them historically cost a lot of money. By identifying these issues ahead of time and then remedying them, you take the chance that the inspection will kill your deal virtually off the table.

Yes, it’s going to cost you a few hundred dollars, but your return on the investment (your home sold and tens of thousands of dollars in equity gained) are well worth it. Not to mention, you won’t have to experience the pain and suffering that comes with a real estate deal that gets blown up by a home inspection.

Appraisal Value Comes in Low

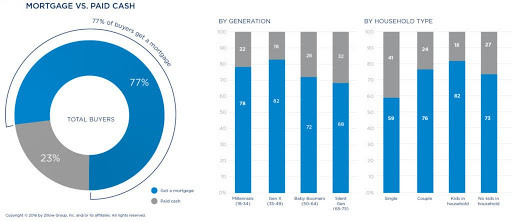

Roughly three quarters of buyers will get financing to buy a home. Historically mortgage lenders will give a loan to a buyer that is a percentage of the sales price or appraised value, while taking the lesser of these two figures into consideration for their decision.

Consequently, any appraised value on your home that comes in lower than the sales price could will impact negatively the amount the bank will lend the buyer. In fact, in most cases, a low appraisal amount will knock the buyer out of consideration to buy your home.

In addition to that, even if they could, most buyers may not want to pay more money for a house than it is worth. This means that the only real solution is for the seller is to lower the sales price to keep the buyer on board.

Yes, there can be what’s called a “review appraisal”, but those are often hard to come by and it’s rare that the appraisal comes in any higher the second time around.

Your best bet as a seller is to price the home very close to market value. In many instances where the home didn’t appraise, the seller priced their home above market value and got fairly lucky with a buyer who was willing to pay their price.

Sometimes, the best strategy is to price a little below market value, get more buyers looking at your home who will put in an offer and create an auction atmosphere where you can drive the price of the home up to market value to get the most amount of money for your home.

Pricing is part science and part art. Make sure you have a great agent who’s an expert on what’s going on in the market so your home gets priced properly and appraises for full value for the bank.

Issues with the title

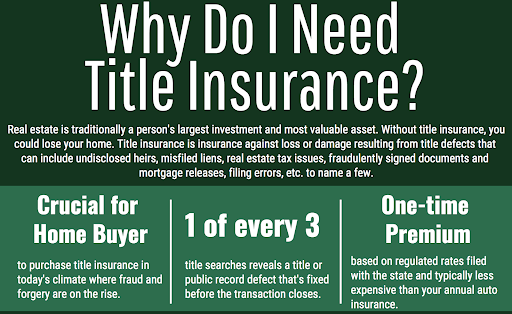

A normal course of action when a home transfers between owners is to review the title history on the property. As well, it’s usually mandatory when someone is applying for a mortgage loan to buy a home.

This process essentially determines if the seller clearly holds title to the property or what obstacles need to be cleared before the seller can convey title to the buyer at closing. In most cases, there are minor issues that can be resolved easily prior to closing by the title company and you, the seller.

In other instances, however, you’ll need to get a real estate lawyer involved to resolve any issues that have come up..

Most of the time, things go smoothly with the title search prior to closing. However, when issues do arise, they can derail a home sale for days and weeks at a time.

To get ahead of this problem, make sure that your title insurance policy is current on its payments. As well, you may want to get the name and number of a good real estate attorney from your agent to ensure that you have someone at the ready to put any issues to rest that arise during the title search.

The important thing to do here is work with your buyer to come to a conclusion that’s satisfactory to both parties. When you do that, you can overcome almost any obstacle to closing the sale.

The most important thing to do when issues arise is to remain calm. Virtually every challenge that arises in a home sale can be resolved with some patience, determination and the assistance of trained professionals.