Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

Mortgage interest for both first and second (home equity) mortgages, mortgage interest for investment properties are among the list of deductions you can take on your taxes.

This is another reason why owning a home is more favorable than renting. In addition to building equity in a home that you can call yours, you have the ability to reduce the amount of taxes you pay.

Here’s key information you need to know about the valuable interest write off deduction.

What is tax deductible interest?

The Internal Revenue Service (IRS) tax code allows for tax deductions that can be used to reduce the taxable income of certain taxpayers.

For example, an individual who qualifies for a $5,000 tax deduction can claim this amount against their taxable income of $50,000, their effective tax rate would then be calculated on $50,000 - $5,000 = $45,000 rather than the $50,000 in gross income they earned.

The interest payments made on certain loan repayments - like mortgages on primary and investment properties - can be claimed as tax deductible on your federal income tax return.

These interest payments are referred to as tax deductible interest.

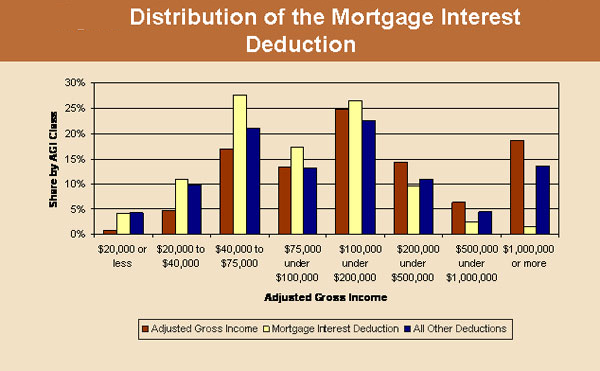

The amount of money that you can claim as tax deductible is based on your tax bracket. For instance, if you’re in the 30% tax bracket and you have $3,000 tax deductible interest in a given tax year, you’ll save $1,000 on your tax bill.

Effectively, that loan cost you $2,000 instead of $3,000.

Your Mortgage Interest Tax Deduction

You would claim the interest payments made on your mortgage as tax deductible on your federal income tax return using a form called Mortgage Interest Statement or in IRS speak, Form 1098.

Form 1098 reports how much an individual or sole proprietor paid in mortgage interest during the tax year. Your mortgage lender is required by the IRS to provide this form to you as long as the home is a residence that has been built on, grown on or attached to the land. This is the definition of real property as the IRS sees it.

A home is defined as a space that has basic living amenities including cooking equipment, a bathroom, and sleeping areas. Homes, as identified by the IRS, include a house, condominium, mobile home, yacht, co-operative, rancher, boat, etc..

As well, the IRS states that mortgages that qualify for the interest write-off deduction include first and second mortgages, home equity loans, and refinanced mortgages.

You’ll want to consult with a qualified tax advisor if you would like a better understanding of how mortgage interest deductions work. Additionally, a qualified tax advisor can help you prepare your tax return to maximize the deductions you are due.

Keep close track of the mortgage interest you pay every year and make sure you give your accountant the documentation he needs to squeeze every ounce of interest deduction from your taxes for you.