Buying a new home can be overwhelming.

Between understanding the financial aspects of your loan and all the paperwork required to buy your home, things can get a little crazy.

One of the biggest parts of getting a new home is figuring out the terms and conditions of your mortgage. Two of the biggest areas that impact your loan are credit and your down payment.

In this post, we’ll cover both and also explain how to determine the down payment on your new home.

Understanding your down payment

When you buy a home, it’s common for you to be required to provide some of your own money upfront to secure the home and your mortgage. In many cases, buyers state that coming up with a down payment for a house is the most challenging part of the home buying process.

In order to ensure that you can afford a down payment and subsequently, the house, It’s a good idea to review your finances early on the process so you have a clear idea of what you’ll be able to afford for a down payment.

The thing you need to know here is that the more money you put down for your mortgage and the purchase process, the lower your monthly mortgage payments will be. The average down payment that most people put down is 10%, but many loan programs will allow you to buy a home with as little as 5% down (or less) if you qualify for the program

Note: there are zero-down loans available, but you’ll need to qualify for them just as you would for any other loan. In some cases, they may be a bit more stringent than other loans, but they are still viable loan options for buying a home.

Understanding your credit scores

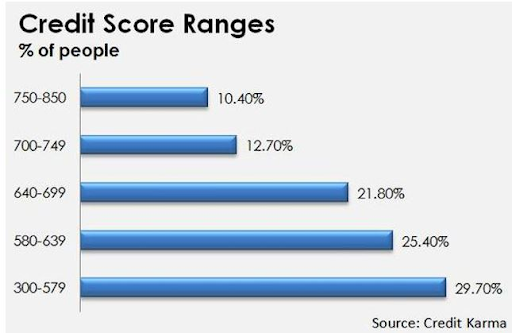

As mentioned previously, your credit scores play a huge role in the mortgage you get, the down payment that’s required and what your interest rate will be.

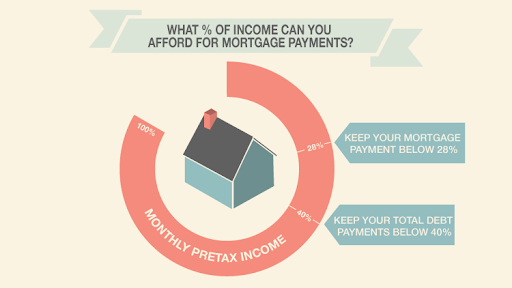

To determine all these things, your lender is going to review your credit history and debt in relation to your total assets. Your debt-to-income and debt-to-assets ratios can affect how much you’re able to borrow and whether or not you qualify for certain types of home loans.

How your down payment impacts your home purchase

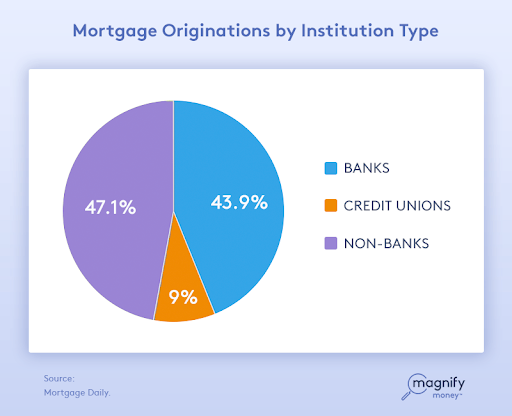

Lenders want you to have some skin in the game. It’s their way of making sure you’re serious about buying a home. As well, it offsets their costs in helping originate and fund your loan. They are required on most loans these days. Here are some other ways your down payment impacts your overall home buying process:

-

The larger your down payment, the less you’ll have to cover with a mortgage, and therefore, the lower your monthly loan payments will be.

-

If you have a very small down payment, you’re likely limiting the number of mortgages for which you qualify. As well, you might be charged a higher interest rate on those you do.

-

Conversely, the more you can put down, the more mortgage options you’ll have.

-

For any down payment less than 20% of the asking price, your lender may ask you to also pay Private Mortgage Insurance (PMI). PMI protects the lender’s investment in you if you default on the loan.

-

Lenders sometimes allow sellers to cover less of the closing costs when a buyer has a very small down payment.

Now, if you haven’t been able to save somewhere between 3% to 5% of the price of the house you’re considering, you may need to ask yourself if you’re financially prepared to buy a home.

It may be best to continue saving so that you have enough money for the down payment, associated closing costs and for the upkeep of your home after you move in. There are down payment assistance programs as well as gifts you can get for down payments, but you’ll still want to have some money saved so that you’re not completely depending on just those programs to buy your home.

What will be your payment on your new home?

There are a number of mortgage calculators on the Internet that will tell you what your mortgage payment will be. These programs, while helpful, don’t give you the whole picture.

Here’s a breakdown of what your monthly home payment will look like:

Principle: This is the actual amount of money that the bank loans you for your home. It doesn’t contain interest or any other aspect of your monthly payment.

Interest: This is the fee the bank charges you for loaning you the money. It’s calculated based upon the length of time you choose to pay back your loan, usually 15 or 30 years.

Taxes: Every municipality in the United States collects taxes to pay for state- and city-funded initiatives. Your taxes are often escrowed by the bank from your monthly payments and then paid to the city in which you live on an annual or semi-annual basis. Your payment for taxes will be taken monthly with your mortgage payment.

Insurance: Your mortgage company is going to require you to keep insurance on your home in the event of fire, theft or damage. If something in your house - or your whole house - needs to be repaired or replaced, your home insurance will cover a large portion of what needs to be taken care of. Again, your insurance is likely paid semi-annually or annually, but you pay a portion of it each month with your payment.

Actual monthly payments are calculated using these four elements plus a lot of other factors like prepaid interest and prorations for taxes and insurance.

Your best bet is to consult with a skilled lender so they can cover what the numbers will look like for you before you plunk down your hard-earned cash to buy a home.