Getting preapproved for a mortgage is a major step in buying a home. When done properly, it’s like having cash in your hands so you can negotiate effectively with a seller to buy a home.

It’s easily one of the most important things you can do in order to buy the home of your dreams.

But its name gives you a hint as to how fragile this financing instrument can be.

You see, it’s a “pre” approval, which means you’re not completely approved yet.

Even if the conditions to your pre-approval are minimal, i.e., subject to the home appraising, you are still going to have your credit report pulled again and your employment confirmed by the lender a day or two before your loan closes.

As such, you’re not going to want to make any substantive changes to your financial situation until after you close on your home.

Here’s why you should wait to buy that are until after your home purchase.

Your debt-to-income ratio could be affected

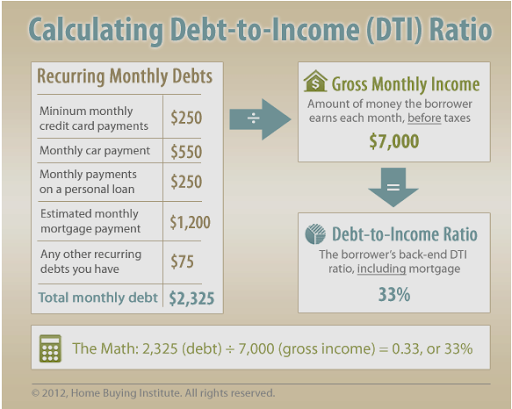

Your debt-to-income (DTI) ratio is the ratio between your gross monthly income (the total amount of money you bring in each month) and your total monthly debt payments (the money you pay for recurring debt, like mortgages and car payments and ongoing monthly payments like medical bills, food and gas, etc.).

Here’s an example: Say you pay $1,500 a month on your mortgage. You pay $500 a month for your automobile loan and other than that, have no other substantive debt. Your total monthly debt payments come to $2,000. At the same time, let’s assume your gross monthly income - the money you earn before taxes and any deductions you take is $6,000.

Total monthly debt payments ($2,000)/Gross monthly income ($6,000) = DTI 33%.

The lower your DTI is the, the better risk you are as an investment for the lender in giving you a mortgage.

From an industry standard perspective, you don’t want your DTI to go above 43%. At 43% or lower, you get a qualified mortgage that has much better rates and terms and limits the fees you can and will be charged on your mortgage.

Your goal should be to keep your DTI below 36% as that’s where the most favorable loan rates and terms will be made available to you by lenders.

All of this said, if you go buy a car before your home purchase, you could affect your DTI and either affect the terms of your loan negatively or not get a loan at all.

Your credit could be affected

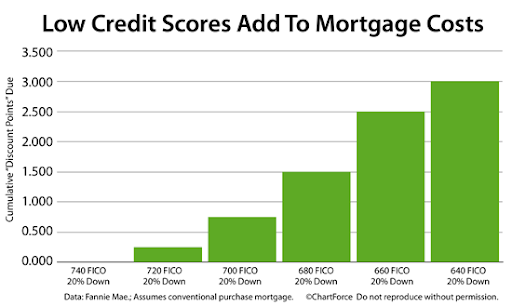

As you know, your credit is a main component of getting a great mortgage on your home.

Like your DTI, there are limits to where you want your credit to be, but in this case, higher is better than lower.

The higher your credit score is, the better the banks feel about lending you money. They show his in terms of a lower interest rate, less money down and better terms on your loan.

The lowest interest rate that will get you a loan is likely a 520 and that would be for an FHA loan. And with that score, you’re probably looking at a 10% down payment.

If you can get your score up to 580, you have a much better chance of getting a 3.5% down payment.

In general, however, if you want more favorable rates, terms, conditions and down payment options for your loan, you’ll need a credit score of 680 or higher.

Here’s the thing: virtually any purchase you make where you need your credit as part of the process will impact your credit score and drive it down for a period of time until you start making regular payments.

A single inquiry on your credit for an auto loan usually only impacts your credit score about 7 points. But if the auto dealer shops your credit for the best deal, you could have 5 to 10 inquiries on your credit report that could drop it 50 points or more.

The good news is that they will drop off in about 14 days.

The bad news is that if you do this before your mortgage funds, it could affect your credit negatively enough to either get you less favorable terms on your loan or worse, keep you from getting a loan at all.

Certainly, inquiries on your credit neither drive your credit down dramatically in the short term nor hurt it over the long term.

Unfortunately, even a small change in your credit can impact your ability to get the right loan or even a loan at all.

Once you’re credit has been pulled and you’ve been pre-approved, the best thing to do is not to buy a car. Or, for that matter, anything else where your credit will need to be pulled and used for the purchase.

Rather, sit tight, keep an eye on the car you want and wait until your loan closes. After that, test drive until your heart’s content and get that new rig.

It’s one of the smartest things you can do for your mortgage.